A charter party bill of lading is a specialized document used in international shipping and operates within the context of a charter party agreement. Here, the party chartering(renting) the vessel hires a vessel in order to take its goods from port A to port B within a certain period of time.

Charter party shipments are contract between the owner of the vessel and the charterer who is usually the applicant or the beneficiary, depending on the Incoterm that is used in the documentary credit.

when is CPBL used:

a)CPBL is used in bulk shipment cargo:

It is used in international trade in moving a bulk shipment cargo or commodity Cargo from Port of Loading to port of discharge .

Bulk shipment carriers, are vital for transporting commodities like grain, coal, and minerals.

They are categorized based on Deadweight Tonnage (DWT), which reflecs their cargo-carrying capacity. Size: 1,000-10,000 DWT

b) When a shipper or a group of shippers arrange to charter a vessel:

To transport their goods to a final destination, a vessel is chartered, a CPBL comes into play.This chartered vessel is meant to move the goods exclusively for such shipper or shippers.

When do group of shippers come together to chatter a vessel for trade

The group of Shippers have less than container load or LCL cargo they chatter a vessel if the port of discharge is the same.

In such cases, as a proof of receipt of goods, the charterer who charters the ship issues a document of title which is called Charter party bill of lading to the shipper.

How It Works:

when a shipper (or a group of shippers) charters a vessel. This means they hire the vessel to transport their goods from one port (l Port A) to another (Port B) within a specified period.

As proof of receipt of goods, the charterer (the party chartering the vessel) issues a Charter Party Bill of Lading.

Unlike a conventional bill of lading, which typically involves a carrier transporting goods for multiple shippers, a CPBL is tailored to a specific charter party contract.

what is charter party clause:

The goods are loaded and discharged according to the terms of Charter Party contract and not according to the Bill of lading issued by the carrier

Parties involved in CPBL:

A charterer hires the vessel and issues bill of lading to the shipper or the consignee according to the incoterms.

Identification of the key parties, including the shipowner, charterer, and often the consignee or receiver of the cargo

Key Points: UCP 600 sub-article 22 (a) (i) states that a CPBL must appear to have been signed by:

- The master or a named agent for or on behalf of the master.

- The owner or a named agent for or on behalf of the owner.

- The charterer or a named agent for or on behalf of the charterer.

- Notably, a carrier (or its agent) cannot sign a CPBL, unlike most other transport documents. This distinction where a carrier cannot sign in CPBL is to asisst the document examiners to identify who the actual contract has been made to.

Bills of Lading & Charter Party

• Once the cargo has been shipped under a Chartered vessel it is clear that the ship owner can be a party to different contracts (the charter party and the bill of lading) with two different contracting parties (the charterer under the charter party and the consignee under the bill of lading).

conflicting orders with different contracts for the same vessel

Example ; Employment orders given by the charterer under the charter party may put the owner in breach of his obligations to the cargo owner under the bill of lading.

• An order given by a charterer to change the port of discharge from Port A to B after the Bills of lading have been released for Port A would if the shipowner complied with them make him guilty of deviation under the bill of lading contract.

• This could seriously prejudice his insurance cover.

Which is the governing contract of carriage-The Charter Party or the Bill of Lading?

Example 1

• A is a seller of goods on CIF terms to B. Under that contract it is the duty of A to arrange the transportation of the goods to B and in order to perform his duties under the sale of contract A charters a ship from owner C.

• Once the cargo has been shipped a bill of lading is signed by the ship’s master on behalf of his owner as carriers and released to A as shipper.

• While the bill of lading is held by A it does not operate as a contract of carriage between A and C since there is already a Charter party contract between those two parties.

• When the bill of lading is endorsed by A to B pursuant to the contract of sale then, in the hands of

B it operates as a contract of carriage between B and C. since there is no charter party contract between B and C.

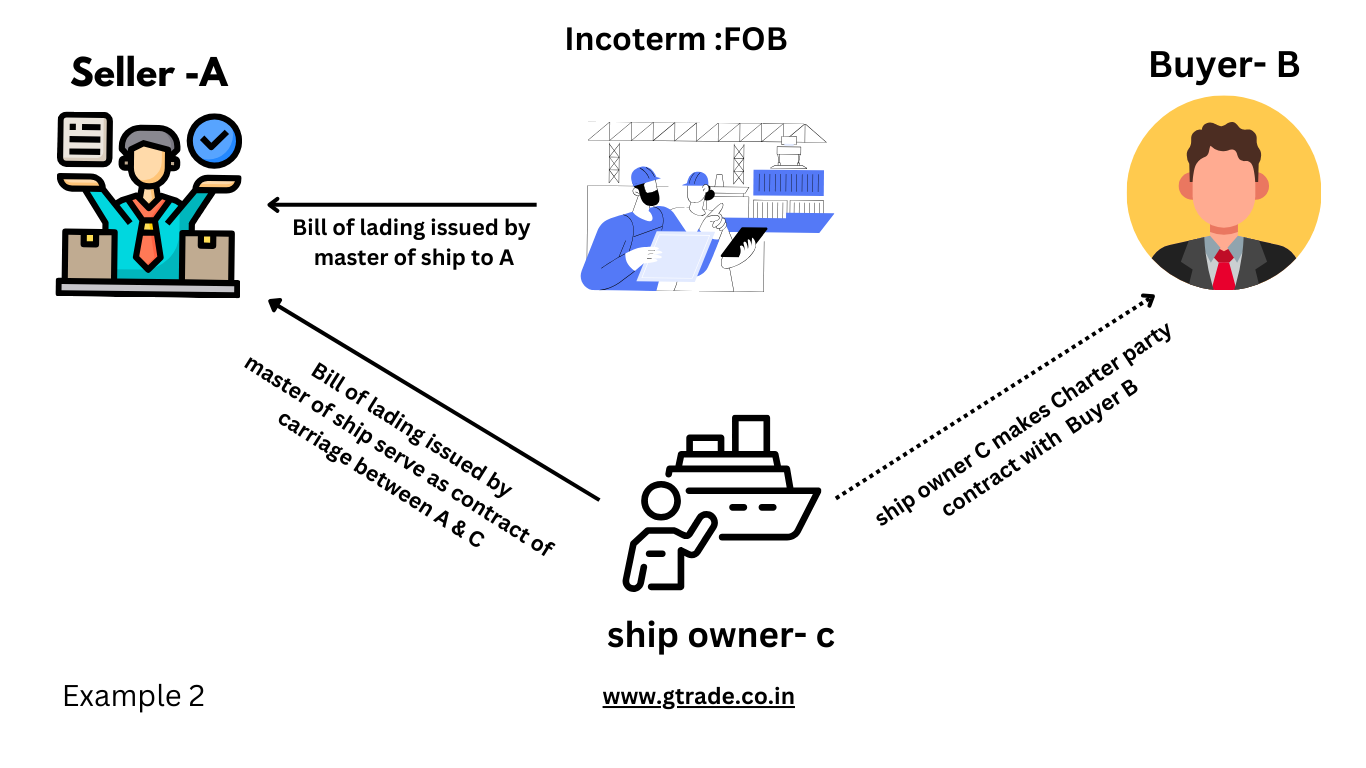

Example 2

• A sells B on FOB terms. In this case the duty to provide the transportation falls on B and he charters the ship C. Once the cargo has been shipped the master releases the bill of lading to A as shipper.

• Whilst the bill of lading is held by A it operates as a contract of carriage between A and C since there is no charter party contract between A and C.

• Once the cargo has been shipped under a Chartered vessel it is clear that the ship owner can be a party to different contracts (the charter party and the bill of lading) with two different contracting parties (the charterer under the charter party and the consignee under the bill of lading).

• Therefore, unless the two contracts are on back-to-back terms there is a potential for confusion and conflict.

Advantages of using a Charter Party Bill of Lading (CPBL) in international shipping:

- Tailored Contracts:

- A CPBL is customized to the terms and conditions of a charter party agreement between the shipper and the shipowner.

- .

- Control Over Rental of Ships:

- CPBLs help regulate the rental of vessels. When a shipper charters an entire vessel or a significant part of it, the CPBL ensures smooth cargo movement.

- Risk Management:

- CPBLs provide proof of cargo receipt and ownership. They serve as both a contract and a cargo receipt.

- Cost-Effectiveness:

- Charter parties can offer cost benefits, especially when multiple shippers transport the same goods to a common destination using the full loading capacity of a ship.

- CPBLs streamline document processing, reducing paperwork and storage costs.

However, it’s essential to note that CPBLs also come with their own set of risks, including disputes, cargo damage, or payment problems. Therefore careful handling and understanding of the charter party terms are crucial in maximizing the benefits of CPBLs