Different types of LC (Letter of credit) are used in international trade finance.

International trade finance is associated with payment risks under different circumstances and conditions. The the LCs were modified with the objective to serve the traders of the international market to deal with different types of demands and conditions and different types of LCs were invented.

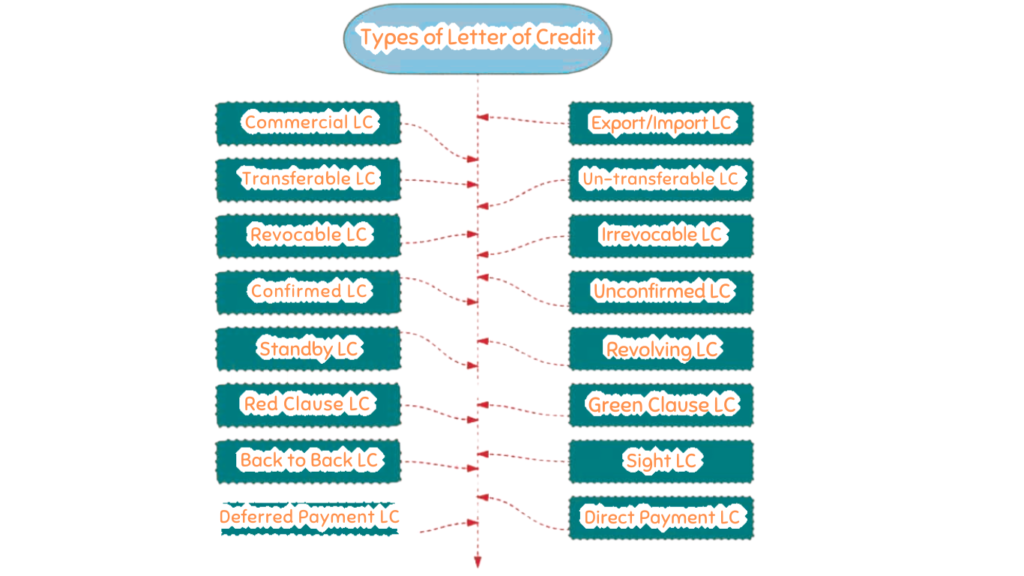

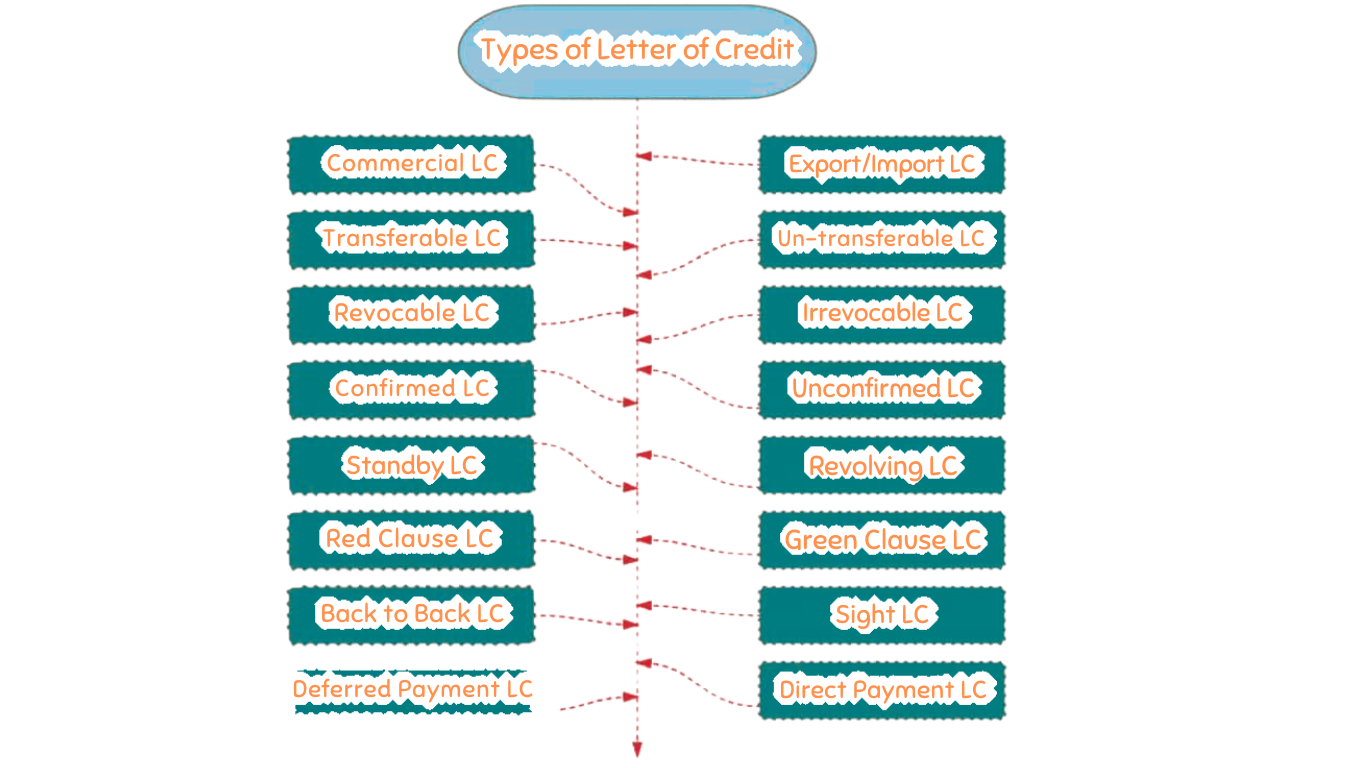

The different types of LC( Letter of credit) include:

Commercial Letter of Credit:

- These are the most common type of LCs. They guarantee that the seller will be paid for a large transaction.

- Commercial LCs are used in international or foreign exchanges and act as payment insurance from a financial institution to the transaction parties.

- They can be either revocable (terms can be amended/cancelled by the issuing bank) or irrevocable (terms cannot be changed).

- Irrevocable LCs provide a higher level of security for sellers.

Standby Letter of Credit: SBLC

- These LCs serve as a backup payment method if the buyer fails to fulfill their payment obligations.

- They are often used in situations where there is a risk of non-payment or default.

- the seller can claim the payment using SBLC

- Standby LCs are commonly used in construction contracts, real estate transactions, and other business agreements.

Revolving Letter of Credit:

- Revolving LCs allow for multiple transactions within a specified period.

- The credit limit is restored after each transaction, making it suitable for ongoing business relationships.

- They are commonly used for import/export businesses with regular shipments.

Red Clause Letter of Credit:

- These LCs allow for an advance payment to the beneficiary (seller) before the shipment of goods.

- The “red clause” refers to a special clause in the LC that allows for this advance payment.

- Red clause LCs are useful when the seller needs funds to prepare the goods for shipment.

Transferable Letter of Credit:

- These LCs allow the beneficiary (seller) to transfer all or part of the credit to another party.

- Useful when there are intermediaries involved in the transaction.

Back-to-Back Letter of Credit:

In a back-to-back LC, the exporter (beneficiary) requests their bank to issue an LC in favor of their supplier/manufacturer Offering the main lc issued in his favor as security.

This refers to a second set of credit termed as back to back credit or Back to Back LC

This allows the exporter to procure raw materials or goods based on the export LC received by them.

Green Clause LC: It is an extended version of Red clause Credit which not only provides an advance towards purchase processing and packaging but also for warehousing and insurance charges at port when the goods are stored pending due to non availability of ships or shipping space.

the money under this credit is advanced after after the goods are put in bonded warehouse till the goods are loaded onto the ship or shipping space.

Instalment LC:

Installment credit calls for the full value of the goods to be shipped but stipulates that the shipments be made in specific quantities at stated periods or Intervals. This means that partial shipment under installment credit are made in specific quantities at specified intervals.

Transit LC:

The services of a bank in a third country would be utilized. this happens when the issuing bank of the buyer has no correspondent relations with any bank in the beneficiaries country.

Transit LC is used by a small country whose credits may not be accepted in another country, in such case the issuing bank may request a bank in 3rd country to issue the credit on its behalf.