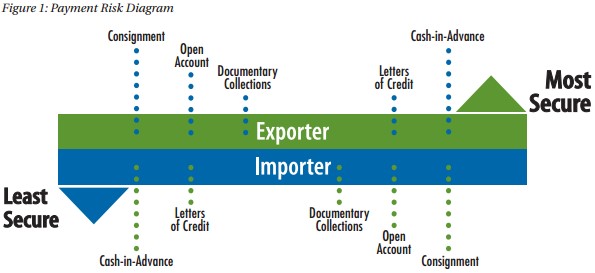

International trade finance involves four different payment methods a) Advanced payment b) Open account c) Documentary collection d) Documentary credit or LC transaction. An interantional trader, might be wondering how to recieve payment in export import trade. well international trade finance has different payment methods which can be executed by Exporter or importer depending upon their risk assessment.

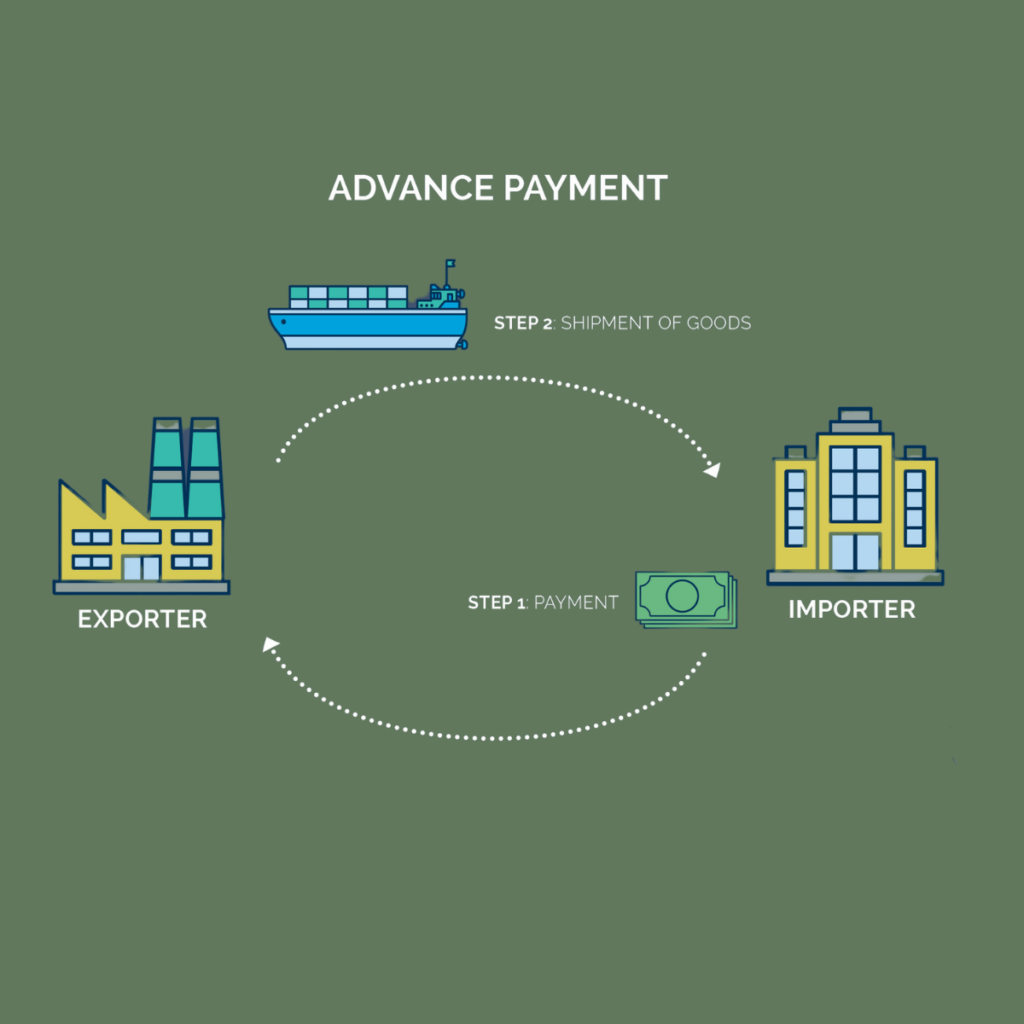

Advanced payment–

Under this method the exporter will ship goods only after the payment is made by the importer or buyer to the exporter.

This is the most riskier payment method for the importer, as the importer pays early.

This type of payment is done when a first time buyer or importer is making a transaction with an exporter and the creditworthiness of the buyer is not known to the exporter.

this method provides exporter a great degree of protection.

Most importers or buyers however are not willing to bear all the risk by prepaying an order so many times the advance is made only in part payment.

Open account

Under this payment terms the exporter dispatches the goods directly to the importer on an agreement of payment at a later date.

In some agreements the payment is made after the goods are sold by the buyer so this method carries a greater risk of non payment from the importer and they will there are no legal employees to enforce payment in this method.

It is the cheapest method of receiving payment, so open account transactions are more suitable for subsidiary and parent companies or between creditworthy buyers or buyers with a longstanding trade relationship

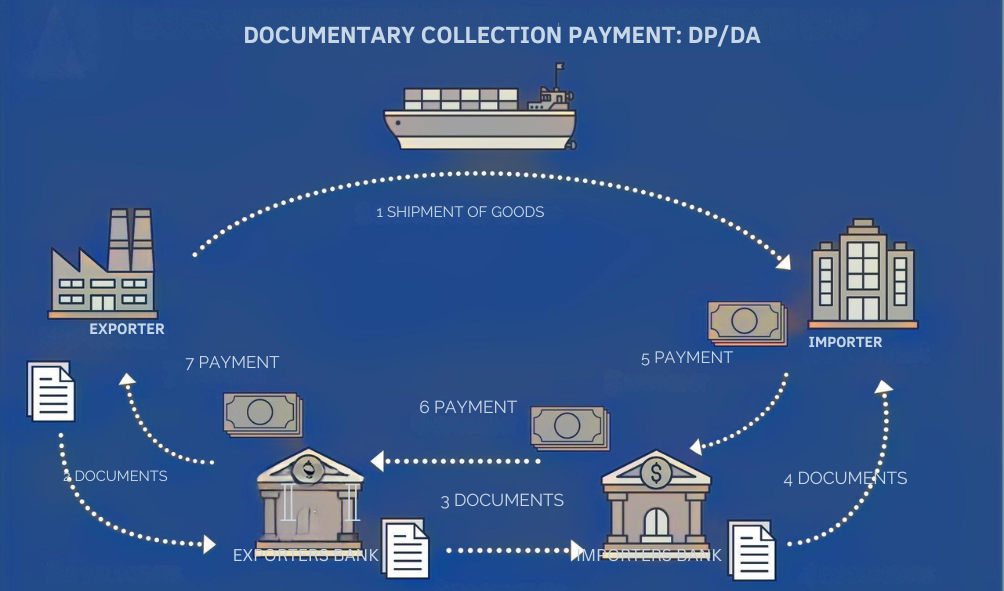

Documentary collection

- In this payment method both the banks play the role of a collecting agent of documents between the exporter and importer.

- most trade transactions involving a draft or bill of exchange are processed through banking channels and it is known as documentary collection.

the major advantages of this method over open account are

- the sellers bank acts as the sellers agent

- the buyers bank or subsidiary bank of the sellers bank acts as a buyers agent.

- it is governed by the ICC uniform rules for collections.

- from the sellers point of view if the seller needs to take action against non payment he or she can take legal action.

- from the buyers point of view payment is made only after goods are received.

There are two types of documentary collections depending upon the bill of exchange involved.

Bill of exchange or draft is a promise drawn by the exporter instructing the buyer to pay the face amount of the draft ,upon presentation the draft. it represents the exporter’s formal demand on payment from the buyer.

these are two types of drafts

a) sight draft which is involved with collection under documents against payment DP

b)usance traft which is involved with collection under documents against acceptance DA

DP-collection under documents against payment

Collection under documents against payment or DP if shipment is made under a sight draft the collecting bank is instructed to deliver documents only against payment it provides the exporters with some protection since the banks will release The shipping documents only according to the exporters instructions.

The important features of this payment method are-

The buyer needs the shipping documents to pick up the merchandise sometimes foods reach the dock much earlier than documents reach the bank.

If the goods are not as per the ordered quality the importer will lose as payment is already made.

DA- Collection under documents against acceptance

If a shipment is made under a time draft or a usance draft, The exporter provides instructions to the buyers bank to release a shipping DA

The important features of this method are-

By accepting the draft the buyer promises to pay the exporter at a specified future date consequently the buyer is able to The merchandise and check the quality of the goods prior to payment it might create the risk of non payment to the exporter’

It is the buyers responsibility to honor the draft at maturity in this case exporter provides the financing in terms of time and is dependent upon the buyers financial integrity to pay the draft at maturity.

Sometimes after checking goods the importer refuses to pay so the seller may have to arrange some other customer in the same country or in a different country.

Documentary credit or letter of credit

It is a payment instrument issued by a bank on behalf of the importer or buyer promising to pay the exporter upon presentation of all documents in compliance with the terms stipulated in the letter of credit. the main characterstics of LC are

The exporter is assured of receiving payment from the issuing bank as long as he or she presents documents in accordance with the LC .

It is important to point out that the issuing bank is obligated to honor drawings under the LC regardless of the buyer’s ability of willingness to pay.

The importer does not have to pay for the goods and shipment is made and documents are presented in good order however the importer must rely upon the exporter to ship the goods as described in the documents since the lc does not guarantee that the goods purchased will be those invoiced and shipped.

All the lc’s subject to the uniform customs and practices of documentary credit 2007 revision ICC publication #600 ucp are constructed to be irrevocable lc’s under ucp 600 all lc’s are treated as irrevocable even if there is no indication to that effect.

An irrevocable LC cannot be amended or canceled without the consent of the issuing bank the confirming bank if any and the exporter.

This allows the exporter to procure the goods or prepare them for shipment with the assurance of payment will be received if the stipulated documents are presented and the terms and conditions are of the credit are complied with.