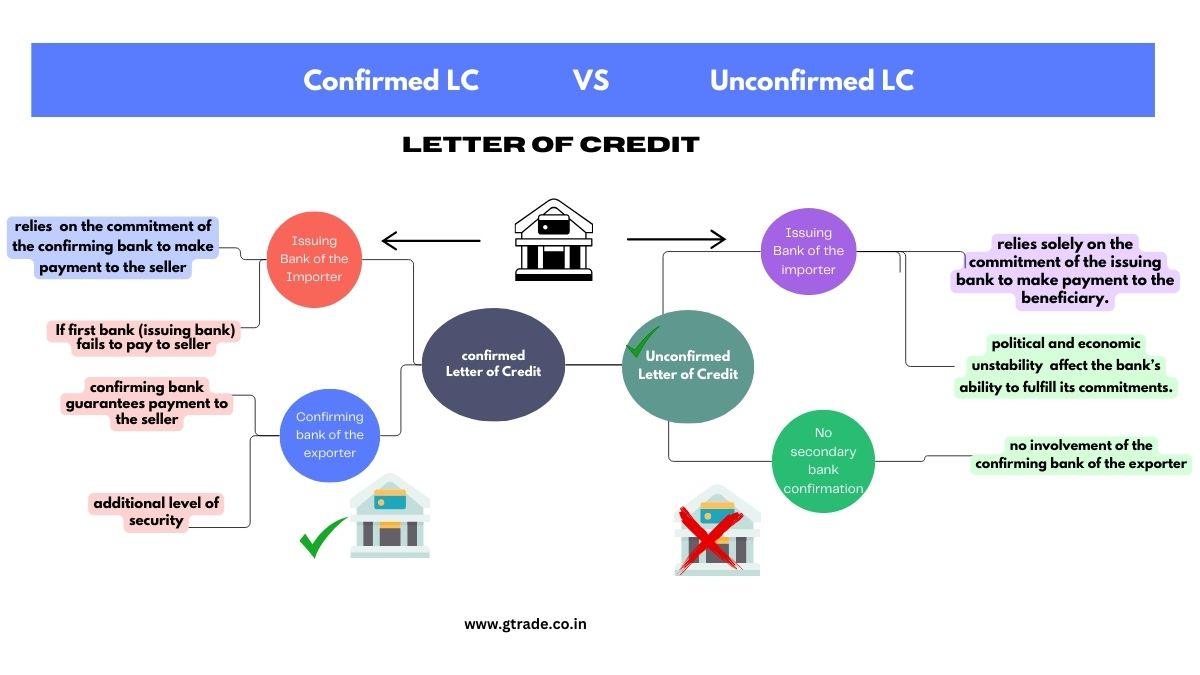

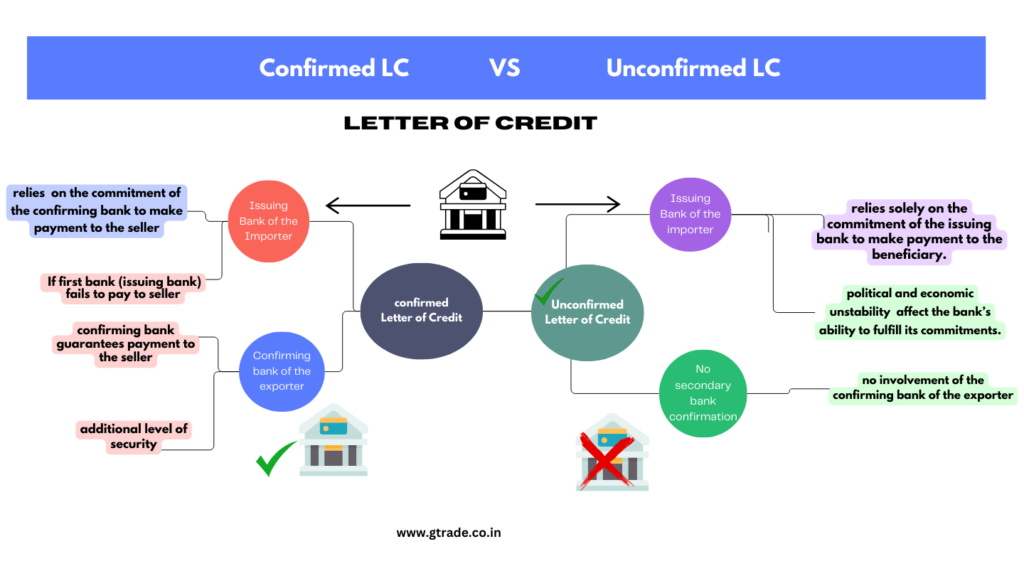

Understanding the difference between confirmed Letter of Credit and unconfirmed LC (letter of credit)

Confirmed Letter of Credit:

- A confirmed LC provides an additional level of security by involving a second bank (often called a confirming bank).

- If the first bank (issuing bank) fails to pay, the confirming bank guarantees payment to the beneficiary (usually the seller or exporter).

- Confirmed LCs are commonly used in international trade and business transactions where substantial amounts of money are at stake.

- The confirming bank’s involvement decreases the risk of default for the seller.

- Having a confirmed LC assures the seller that payment will be made even if the issuing bank faces difficulties.

Unconfirmed Letter of Credit:

- An unconfirmed LC is simply a letter of credit issued by the issuing bank without involving a second bank.

- It relies solely on the commitment of the issuing bank to make payment to the beneficiary.

- Unconfirmed LCs are often simpler and more convenient for many transactions.

- They come with lower costs and quicker processing compared to confirmed LCs.

- However, they offer less security to the beneficiary because there is no additional guarantee from a confirming bank.

In summary, a confirmed LC involves two banks (the issuing bank and the confirming bank), while an unconfirmed LC relies solely on the issuing bank’s commitment to payment. The choice between the two depends on the level of security desired in international trade transactions.

Risks associated with unconfirmed lc

The risks associated with an unconfirmed letter of credit (LC) primarily revolve around the creditworthiness and reliability of the issuing bank. Here are some key risks:

- Credit Risk: The entire credit risk is on the issuing bank. If the issuing bank fails to honor its payment obligations, the seller has no recourse to another bank for payment.

- Country Risk: There is a risk related to the political and economic stability of the issuing bank’s country. Unfavorable conditions could affect the bank’s ability to fulfill its commitments.

- Bank Failure: The risk of bank failure is a concern. If the issuing bank goes bankrupt or faces financial difficulties, the beneficiary may not receive payment.

- Foreign Exchange Risk: If the LC is in a foreign currency, there is a risk of loss due to fluctuations in exchange rates between the time of shipment and the time of payment.

- Legal Risk: Different countries have different laws and regulations, which can complicate the process if a dispute arises.

- Fraud Risk: There is always a risk of fraud, such as presenting false documents or non-shipment of goods, which can be more challenging to resolve without a confirming bank’s involvement.

- Transfer Risk: The risk that the issuing bank will not be able to transfer funds due to foreign exchange regulations or government intervention in its home country.

- Operational Risk: Mistakes or delays in processing the LC can occur, which might lead to late payments or non-payment.

Bottom line:

To mitigate these risks, sellers often prefer a confirmed LC, especially when dealing with new buyers or banks with which they do not have an established relationship. It’s important to assess these risks carefully and consider the additional security of a confirmed LC when engaging in international trade.