An international transaction begins either from the side of the exporter or from an importer based on forces of demand and supply. If importer demands any supply from an exporter the willingness is communicated through import quotation and if exporter makes an offer to sell something to the importers it is called proforma invoice.

Importance of invoice in global shipping

In the context of export-import business, an invoice plays a crucial role. Here’s why it’s important:

- Customs Clearance: A commercial invoice is mandatory for export and import clearance. Customs officials in the buyer’s country use it to assess import duties and taxes.

- Financial Record: It serves as an official record of the financial transaction between the exporter and importer

- Goods Description: The invoice provides an accurate description of the shipped goods, aiding transparency and facilitating customs procedures.

- Duty and Tax Assessment: Customs officials use it to classify products, verify value, and determine origin. Invoice helps in assessment of duties and taxes during clearence.

Proforma Invoice

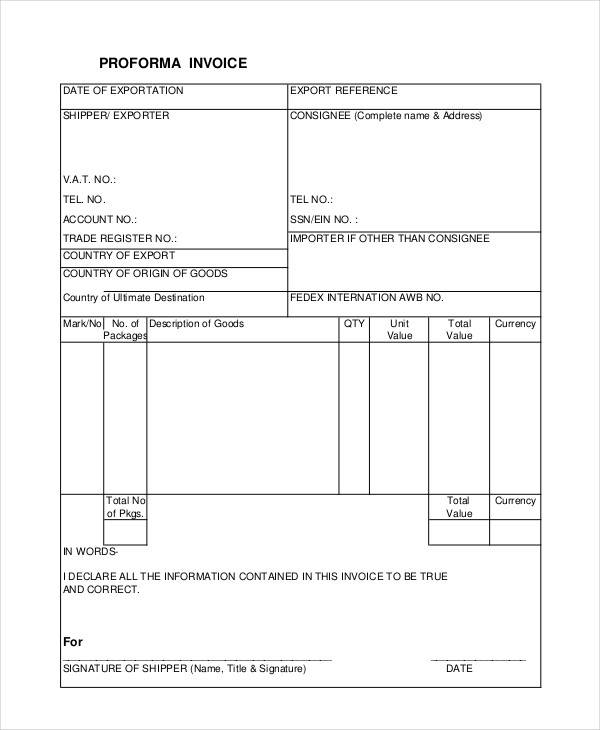

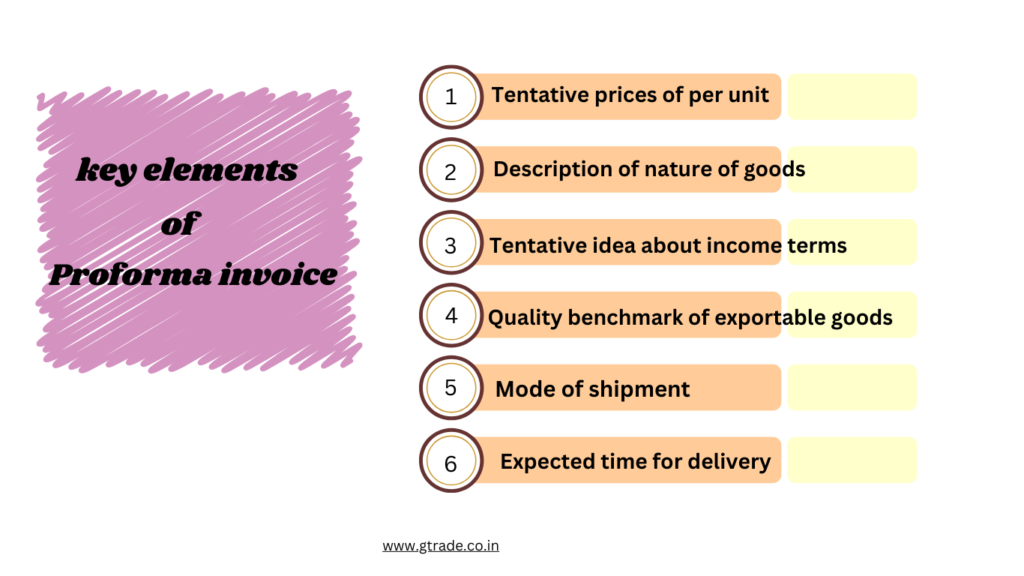

Proforma invoice is prepared by an exporter who wants to sell goods or trade internationally. the proforma invoice includes information about the quantity of goods available for export price per unit, total value. other cargo specifications such as ITC-HS code, weight, quality standards, country of origin, lot size, place of exports, incoterms and payment terms. An exporter provides all the information to the importer with respect to the trade transaction agreed upon.

Exporter and importer negotiate the various terms of trade such as quantity, quality, price, delivery terms, payment terms, currency of invoice, delivery date, port of loading & discharge, place of delivery and other associated issues on the basis of proforma invoice.

what elements are included in proforma invoice:

Commercial invoice

An exporter prepares commercial invoice as an instrument to bill the importer for the goods exported. commercial invoice is a formal demand note issued by an exporter to an importer for payments of goods sold under a sales contract.

Key information elements in the commercial invoice should include:

some countires demand inclusion of the packing and shipping marks as per importers country requirements in commercial invoice.

FAQ’S in invoice types

why commercial invoice is important in global shipping and logistics ?

commercial invoice is also extremely important for customs clearance of goods as Indian customs cannot clear the goods without commercial invoice document.

An exporter also has to submit the copy of the commercial invoice to the authorized bank along with exchange control documents for compliance of FEMA rules.

when is a commercial invoice prepared?

An exporter prepares Commercial invoice After negotiating the terms included in proforma invoice with the importer. The commercial invoice is prepared in advance, to communicate with production department to inform about the quantity to be produced and quality to be complied with. Logistics department so as to inform about booking of shipping space and finance department for arranging the required working capital.

Does commercial Invoice acts as a legal document in case of disputes ?

commercial invoice is the first and foremost principal document that serves as a documentary proof in case of disputes between exporter and importer. The court takes due cognizance of agreed terms and conditions of the commercial invoice in settling the dispute between parties.

Is commercial invoice important to claim export benefits and incentives from government ?

An exporter uses a copy of a duly signed commmercial invoice to claim export benefits and incentives from DGFT and settle the export compliance with regulatory bodies for claiming GST exemption from income tax department.

Hence an exporter should maintain and preserve the copy of the commercial invoice for further purposes such as income tax audit, duty drawback audit and so on.

Where should the copy of commercial invoice needs to be submitted for exporter order execution ?

commercial invoices act as a basis for the preparation of other export documents like shipping bill or bill of export for clearance of goods from customs. An exporter also has to submit a copy of the commercial invoice to the export inspection agency for quality compliance and similarly to the Chamber of Commerce or other notified body for the certificate of origin.

In standard transaction a minimum of 12 copies of commercial invoice are required. Any commercial bank in India while sanctioning the export finance asks for commercial invoice so as to understand the financing needs of an exporter. commercial invoice is issued by the exporter for full realizable amount of goods as per the terms of trade and shows the values of goods.

The UN layout key has prescribed the standard format of commercial invoice. A sample copy of commercial invoice is shown below

customs invoice

In some countries of the world a commercial invoice is demanded in specified forms of the country which is also referred to as customs invoice.

when the commercial invoice is prepared as per the format prescribed by the custom authorities of the import importers country it is called custom invoice. This invoice is required in United States Canada and Australia

Legalized invoice/consular invoice

Some importing countries insist on legalized or visaed commercial invoice and such invoice is known as consular invoice.

when the commercial invoice is duly verified sign by the embassy or consulate of the importer country based in the country of the exporter it is called as consular invoice. embassy/consulate attested invoice becomes legalized consular invoice. This type of invoice is required in countries like Mexico and Middle East countries.

This is done by the importing country so as to keep the record of sensitive imports to the country.

At any point of time, if a country realizes that imports are increasing and it does not have foreign exchange to make payment it can restrict certain items from the importing list. such an arrangement is also used to provide preferential tariffs to friendly countries for trading.

Commercial invoice has been sometime used as a diplomatic weapon to settle other issues with trading countries through the use of non tariff barriers.

The countries which legalize/vizaed the commercial invoice do so in order to maintain the actual database of various imported goods into the country.

In some countries there is a demand for consular or legalized/vised invoice as they make assessment of duty payable on the base of such visaed commercial invoice.

Legalized invoices are demanded in countries such as Turkey, Liberia, Taiwan, Latin American countries. such practices are used in land locked and island nations as they want to control or regulate imports in porous borders.

In majority of the countries there commercial invoice is used to make the assessment of duty payable. commercial invoice commercial invoice is the principal document and must be signed and dated.

Countries that trade globally use the commercial invoice so as to restrict or control imports as the commercial invoice will often specify the whole description about the export and import.